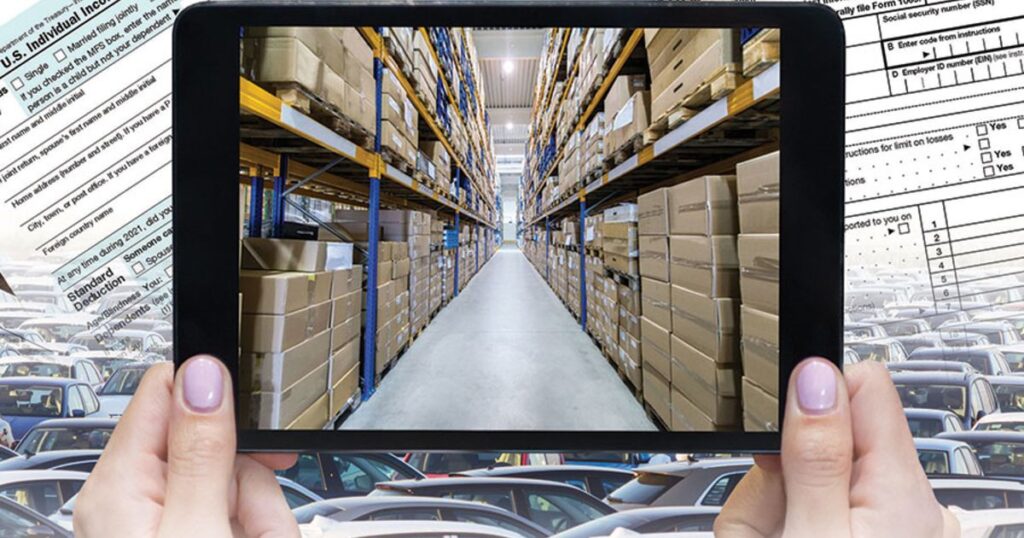

LIFO is a tax deferment tactic extensively used by US corporations that constantly stockpile expensive products like cars. Almost every dealership in America uses it.

LIFO dealerships rely on consistent new-car deliveries to maintain their delay strategy. For 2021, however, COVID-19 production difficulties and chip shortages lowered dealer stockpiles, making long-deferred revenue taxable at the federal and possibly state level.

The National Automobile Dealers Association and the Alliance for Automotive Innovation have requested the Treasury Department to grant interim LIFO relief under Section 473 of the Internal Revenue Code, which would enable dealers up to three years to reestablish normal inventory levels.

Many dealers were unable to replace their new-vehicle inventory due to government actions linked to COVID-19.

Many sellers had tax reports due as early as March 15.

A number of them could be in trouble, Kildee warns. “For those on a tight budget, this might be fatal.”

Treasury Secretary Janet Yellen has not indicated relief.

“”They just didn’t feel they had adequate jurisdiction under the current statute because no one anticipated something like this happening,” Kildee said. We would have made it law if we had.”